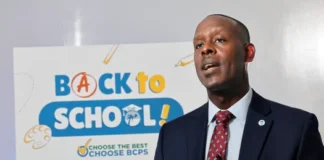

Dariel Fernandez, Miami-Dade County Tax Collector, reiterated his office’s commitment to transparency and due process on February 17 while addressing concerns about financial activity that may benefit entities tied to the Cuban government. Speaking at PortMiami, Fernandez was joined by Congressman Carlos A. Gimenez, county commissioners, Cuban exile leaders, and human rights advocates.

During the press conference, Fernandez drew a clear line between humanitarian aid—such as food, medicine, and essential goods—and luxury commerce, noting that items like Ferraris, jet skis, motorcycles, and jacuzzis do not fall under humanitarian considerations.

The announcement builds on previous enforcement action in December, when Fernandez revoked the licenses of 20 businesses suspected of trading with the Cuban regime, effectively barring them from operating in the county. That move followed an October review in which his office contacted 75 businesses for documentation proving compliance with federal restrictions. Only 48 responded satisfactorily, prompting follow-up notices and subsequent revocations.

“Miami-Dade County will not be used as a platform to finance or sustain the Cuban communist regime,” Fernandez said in December. “As a Cuban emigrant, I know firsthand the suffering inflicted by that government, which remains a threat to U.S. national security.”

Over the past year, the Tax Collector’s Office has continued a methodical review of Cuba-related business activity within its statutory authority. While Fernandez emphasized that his office does not issue federal export licenses or enforce sanctions—authorities that remain under federal jurisdiction—he noted ongoing coordination with agencies including the U.S. Departments of Treasury, State, Commerce, and Homeland Security to share relevant information.

To enhance public accountability, the office launched a Compliance Transparency Page, centralizing records generated during the review. Fernandez stressed, “Transparency is not politics. It is accountability.”

He assured that Miami-Dade County will continue applying the law consistently, cooperating with federal partners, and maintaining open communication with the public.

“Our responsibility under Florida law is to ensure businesses operating in Miami-Dade comply with local and state requirements, including Local Business Tax Receipts,” Fernandez said. “This includes conducting due diligence when concerns are raised and maintaining accurate public records.”

The combined measures highlight the office’s dual approach: enforcing local licensing rules against noncompliant businesses while supporting ongoing transparency and collaboration with federal authorities to address Cuba-linked financial activity in the county.

Residents can access records and further information through the Compliance Transparency Page.